|

ACTUARIAL REVIEW AS AT 31 MARCH 2010

In terms of the Pension Funds Second Amendment Act of 2007, the Surplus

Apportionment date (SAD) of the Fund is 31 March 2008.

The Trustees of the Fund have finalized the Surplus Apportionment Scheme and it

was submitted to the Financial Service Board on 31 August 2011 for approval. A

separate brochure setting out the details of the Surplus Apportionment Scheme

was circulated to the Industry during July 2011.

An actuarial review by Simeka Actuaries (previously Sanlam Actuaries) was

carried out as at

31 March 2010 to assess the financial position of the Fund and

to recommend an interest rate to be declared on your fund credits.

The actuary certified that the Fund was in a sound financial position as at 31

March 2010.

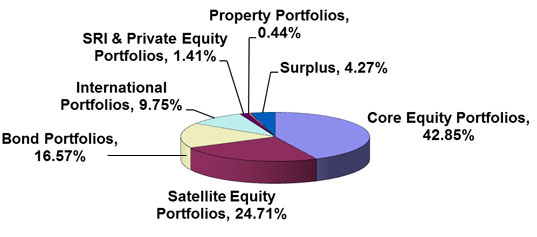

ASSETS

As at the 31 March 2011 the assets of the Fund amounted to

R26 532m . The assets were held in the following types of investments,

per market values, as set out in the notes to the Financial Statements.

INTEREST DECLARATION ON MEMBERS' FUND CREDITS

The Board of Management in consultation with the Actuary to the Fund declared an interest rate of

10 % for the period ended 31 March 2011.

PERIOD |

FUND INTEREST |

|

01/05/91 – 30/06/92

|

15% |

|

01/07/92 – 28/02/93

|

13% |

|

01/03/93 – 31/12/93

|

11% |

|

01/01/94 – 31/12/94

|

22% |

|

01/01/95 – 31/12/95

|

19% |

|

01/01/96 – 31/12/96

|

21% |

|

01/01/97 – 31/12/97

|

15% |

|

01/01/98 – 31/12/98

|

9% |

|

01/01/99 – 31/12/99

|

8% |

|

01/01/00 – 31/12/00

|

9% |

|

01/01/01 – 31/12/01

|

15% |

|

01/01/02 – 31/03/03

|

0% |

|

01/04/03 – 31/03/04

|

15% |

01/04/04 - 31/03/05 |

15% |

01/04/05 – 31/03/06 |

21% |

01/04/06 -31/03/07 |

27,7% |

01/04/07 - 31/03/08 |

10% |

01/04/08 - 31/03/09 |

0% |

01/04/09 - 31/03/10 |

20% |

01/04/10 - 31/03/11 |

10% |

It was further declared that the interim interest rate from 1 April 2011 would be

2% .

|