| |

| Death Benefits |

| |

| |

| Nominating a beneficiary |

| |

In terms of Section 37 (C) of the Pension Funds Act, the Fund is obliged to award and pay the death benefits firstly to proven dependants of the deceased member. Thereafter, the Fund may give consideration to awarding and paying benefits to persons who are not dependants but who have been nominated by the member to receive a portion of the benefits. For this purpose, an updated record of the member's wishes in this regard will be of great assistance to the Trustees in locating both dependants and nominees to ensure they receive any benefits that may be awarded to them.

Therefore, it is very important that the 'Expression of Wish Form' is updated regularly by the member. This form indicates details of dependants and others whom the member wishes to be considered for the payment of benefits and serves as a guide for Trustees when allocating benefits. The benefits will however be distributed in terms of Section 37 (C) of the Act.

|

| |

| |

| Distribution of benefits |

| |

| The Trustees are obliged to distribute benefits in terms of the ranking stipulated in Section 37 (C) of the Act as follows: |

- Allocations should firstly be made to proven dependants in proportions deemed equitable by the Trustees.

- Failing the existence of dependants, the benefit must be distributed to persons nominated in writing by the deceased and in the proportions indicated after settling any debt in the Estate if deceased is insolvent.

- Failing the existence of nominees, the benefit must be paid to the deceased's Estate.

|

| |

| NOTE: The above is merely a summary of the Act. Full details are provided in the Annexures to the Rules of the Funds or in Annexure 'H' of the Death application forms available for download on this web-site. |

| |

| |

| Under what circumstances is a full death benefit payable? |

| |

| Dependants may claim a full death benefit if the member dies whilst contributing to the Funds and |

| |

- if the member dies on or before the age of 69 years.

- was a member of the Permanent Disability Scheme at date of death OR

- death occurred within 6 weeks of leaving service, provided he had at least 2 years' continuous contributory service before he ceased to be employed in the Industry and had not found employment at time of death, OR

- death occurred within 26 weeks of leaving service because of ill health or an injury at work and death is the result of this ill health or injury.

|

| |

| What is a Pension Fund full death benefit? |

| |

- 3 x yearly earnings at the date of death payable as a lump sum

- PLUS the Member's full Fund Credit.

|

| |

| What is a Provident Fund full death benefit? |

| |

- 3 x yearly earnings at the date of death payable as a lump sum

- PLUS the Member's full Fund Credit.

|

| |

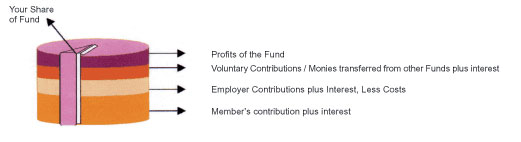

| The member's full FUND CREDIT is made up as follows: |

| |

| The member's contributions with interest + the employer's contribution LESS costs of death, disability and administration with interest + voluntary contributions / monies transferred into the Fund with interest + profits of the Fund. |

| |

|

| |

| |

| Documentation to be completed and supplied by the human resources official in respect of each dependant: |

| |

- A completed 'Application for Death Benefits form' signed by the claimant and Annexures 'A-H'.

- A completed bank mandate form.

- A certificate of service from the Employer.

- A Revenue Form D.

- A certified copy of the Death certificate.

- A certified copy of the marriage certificate, divorce decree or customary union certificate.

- A copy of the Identity document of the dependant and the deceased member.

- A certified copy of the last will of the deceased.

|

| The first four items mentioned above may be downloaded from this web-site |

| |

| Explanation of Forms: |

| |

- Additional information for distribution of benefits to be completed by the applicant (See Annexure 'A').

- Proof of Customary Union/Common law wife affidavit which is to be completed in the absence of a marriage or customary union certificate. Annexure 'B' is to be completed by the common law wife. Annexure 'C' to be completed by an independent party not related to the common law wife. (i.e. family of the deceased member would be acceptable). (See Annexures 'B and C').

- Affidavit by Guardian: Only required if the minor biological children of the deceased member are being taken care of by someone other than their biological parent. (See Annexure 'D').

- Affidavit by Major Dependants: To be completed by any of the major children who were dependent on the deceased at time of death. (See Annexure 'E').

- Affidavit by Other Dependants: (See Annexure 'F')

- Affidavit: An affidavit confirming any other information that is pertinent to the claim. (See Annexure 'G').

|

| |

| |

| How long do the dependants of the deceased have to lodge a claim? |

| |

| In terms of the Pension Funds Act, the dependants have 12 months from the date of the member's death to lodge a claim. If they do not lodge a claim in this period, they may lose the benefit. Although part payments will be made to bona fide dependants during this period, the claim will only be finalized 12 months after the date of death and provided that the required documents have been submitted by the claimants. This is to ensure that all legitimate dependants have been included in the distributions of the benefit. |

| |

| |

| Payment of benefits: |

| |

| Benefits are paid directly into a bank account. Claimants must ensure that their Bank details are completed on the Bank Mandate form. If a claimant does not have a bank or savings account, they can open an account at any bank of their choice. The Funds also have an arrangement with First National Bank to open accounts for our beneficiaries without having to make an initial deposit. |

| |

| For more details go through the Rules of the fund available on this website. |

| |

| |

| |

| |